Long-term deflationary spiral of Japan that lasted 20 years is about to end

- Listed: 04/29/2014 3:51 pm

- Expires: This ad has expired

Japan’s 20-Year Deflationary Spiral Is About To End

Date: Apr 27, 2014

Source: Forbes – by James Gruber

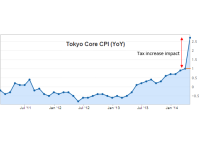

Japan raised its consumption tax rate in 1997 – a recession soon followed as well as a deflationary spiral which has lasted to this day. With this month’s hike in the consumption tax from 5% to 8%, investors are fearful that history may repeat itself.

This fear ignores several key differences. First, there’s no Asian currency crisis to deal with now, unlike in 1997. Second, Japan’s banks are in much better shape than during the 1990s when they held off writing off bad debts. Third, the central bank is engaged in a massive experiment in monetary stimulus this time around. Finally, today’s labor market is very tight, compared to back then.

The last point is crucial and goes to the heart of one of the biggest myths about Abenomics. That is, with or without Shinzo Abe, Japan’s sharply declining working-age population was always going to lead to a tight labor market, resulting in wage pressure and higher inflation. Today’s post will attempt to show that the tipping point for higher wages is near.

In addition, you should see even more stimulus enacted in the coming months as the economy slows. This stimulus – of a gargantuan amount in aggregate – combined with higher wages, may be enough to push inflation higher.

But Japan’s government and central bank are likely to get much more inflation than they bargained for. This risks a sharp spike in interest rates and a bond market rout, with investors fleeing amid concerns about the government’s ability to repay its enormous debt load.

In the ultimate irony, it may not be the deflationary bogey man which finally kills the Japanese economy. Rather, it could be the inflation so beloved by central bankers and economists that does it.

Myth of a Japanese recovery

It’s amazing the extent to which mainstream commentary has embraced the narrative that Abenomics is working and the Japanese economy is recovering. That’s despite almost all of the recent economic data suggesting otherwise.

Let’s run through this data. First, Japan posted its largest-ever trade deficit during the fiscal year to March. The gap between the value of Japan’s exports and its imports grew by more than two-thirds to 13.7 trillion yen (US$134 billion). Gains in exports were almost solely due to the declining yen as export volumes were only up 0.6% for the year. And during the January to March quarter, export volumes were actually down 0.2% in seasonally-adjusted terms.